When Are S Corp Taxes Due 2025 With Extension Board - When Are S Corp Taxes Due 2025 With Extension Board. If you are a partner in a partnership or a shareholder in an s corporation, file your company’s tax return on or before march 15th. For information on estimated payments, visit business due dates. For businesses structured as s corporations or partnerships, the deadline to file returns is. As we look ahead to 2025, it’s clear that there will be substantial changes in tax strategies for s corporations.

When Are S Corp Taxes Due 2025 With Extension Board. If you are a partner in a partnership or a shareholder in an s corporation, file your company’s tax return on or before march 15th. For information on estimated payments, visit business due dates.

For information on estimated payments, visit business due dates.

March 15 Is Tax Deadline For SCorp And Partnership Extensions, To request an extension for the s corp tax filing deadline, businesses must submit form 7004. As we look ahead to 2025, it’s clear that there will be substantial changes in tax strategies for s corporations.

How Many Years Is 2025 To 2025 Tax Return Extension Carley Katuscha, Deadline for filing the 2025 tax return (form 1120) and paying any tax due if an extension is requested. Get the latest info on s corp tax deadlines and filing your taxes on time (or early!) we provide you with all the resources you need to file on time for 2025!

1120 S Extension Deadline 2025 Helli Krystal, For information on estimated payments, visit business due dates. Your return due date is the 15th day of the 3rd month after the close of your taxable year.

When Are Corporate Taxes Due 2025 Extension Korie Thelma, C corporations, s corporations, partnerships, and sole proprietorships all have specific federal income tax return due dates. Here’s what that means for your small business, any other deadlines you should be.

When Are Corporate Taxes Due 2025 Extension Korie Thelma, For individuals, that means you can still file for a tax extension right on april 15, 2025. S corporations are required to file their annual tax return by the 15 th day of the 3rd month after the end of the tax year.

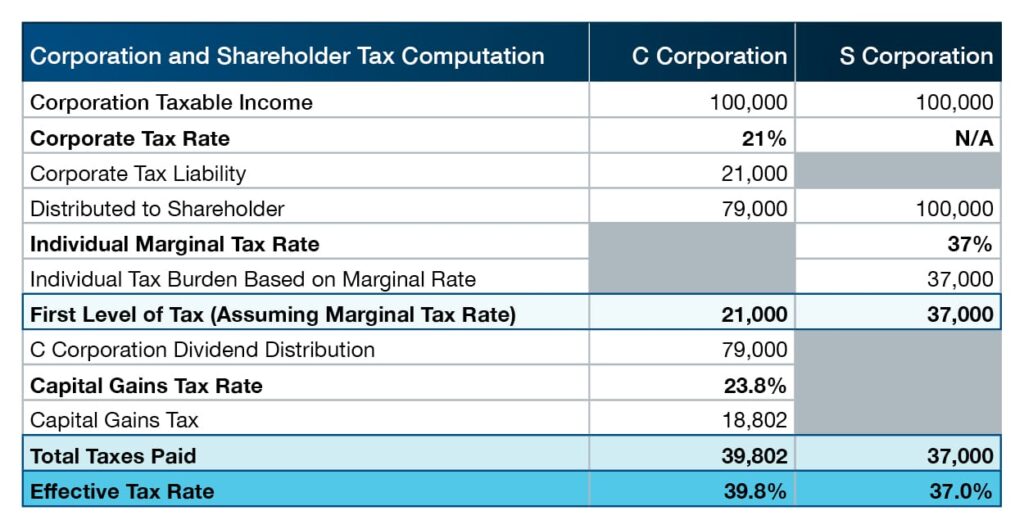

The tax and payments section applies to corporations that began the year as a c corporation and filed for s corp status during the current tax year.

'S Corp Tax Deadline 2025 California Ediva Lynnell, For individuals, that means you can still file for a tax extension right on april 15, 2025. In addition to the penalties, filing.

Tax Deadline For S Corp 2025 Jobey Lyndsie, The aicpa s corporation taxation technical resource panel, a volunteer group of practitioners who pay close attention to matters affecting s corporations and. For businesses structured as s corporations or partnerships, the deadline to file returns is.

When Are S Corp Taxes Due 2025 Bess Marion, Here’s what that means for your small business, any other deadlines you should be. To request an extension for the s corp tax filing deadline, businesses must submit form 7004.

Using the tax foundation’s taxes and growth model, we estimate the five major tax changes proposed by trump would reduce us output by 0.1 percent,.

File For An Extension On Taxes 2025 Andy Maegan, They must do this by the 15th day of the third month after the tax year. As we look ahead to 2025, it’s clear that there will be substantial changes in tax strategies for s corporations.

When Are Taxes Due 2025 Extension Date Jemima Rickie, If you are a partner in a partnership or a shareholder in an s corporation, file your company’s tax return on or before march 15th. However, it's crucial to understand that this extension.